we are talking about Qualified Business Income Deduction in this post. While talking about monitorial affairs, every one of us usually gets attentive. The management of cash is a challenging task. Moreover, it is difficult to carry cash with you all the time. That’s why people try to adopt various methods for handling financial matters. The electronic methods of transferring money have been introduced that assist people in avoiding keeping cash with all the time that can be stolen easily. In this article, we will discuss a new phenomenon that has changed the shape of business paying traditions. So, let’s get started to discuss our main and interesting topic.

Table of Contents

What is a Qualified Business Income Deduction?

The Qualified business pay derivation is an individual allowance restricted to proprietors of pass-through substances. These are sole ownerships (counting self-employed entities), associations, restricted obligation organizations, and S enterprises, which are substances in which proprietors report many business pay on their own profits. CBD Cat Treats – What You Should Know

The QBI derivation is up to 20% of QBI from a pass-through element directing an exchange or business in the U.S. It likewise incorporated up to 20% of qualified land speculation trust profits and qualified traded on an open market organization pay.

Notwithstanding – Qualified Business Income Deduction

as you’ll see, numerous constraints may keep you from taking a certified business pay derivation. The QBI allowance is an individual discount to guarantee whether you take the standard derivation or order individual derivations. The QBI derivation doesn’t decrease business pay or affect independent work charge for proprietors who are treated as independently employed people.

What considers qualified business pay (QBI)?

Qualified business pay (QBI) is basically a lot of benefits from the business. Be that as it may, all the more explicitly, it is the net measure of pay, increase, allowance, and shortfall from your business.

Along these lines, there are numerous changes following fundamental benefit or misfortune to this sum to show up at QBI. In figuring QBI, don’t consider:

Remuneration paid to an organization proprietor worker ensured installments to accomplices, or any installments got by accomplices for administrations other than in the limit of an accomplice. Venture things, for example, capital additions or misfortunes, or profits. Interest pay that is not business interest. Accordingly, the premium on remarkable receivables is considered, the however premium on a financial balance isn’t. Business remainders that were prohibited before 2018 (for example, a home office allowance vestige). QBI must be diminished by payor derivations identified with business pay although they aren’t accounted for on a business return. These include:

- Gain from exchanges investigated Form 4797, which incorporates gain from the offer of business property.

- The allowance for one-portion of independent work charge.

- The independently employed medical coverage allowance.

- The allowance for commitments to an independently employed SEP, SIMPLE, or another qualified retirement plan.

- Unreimbursed association costs asserted by an accomplice on their own return.

Does available pay make a difference while computing the QBI derivation?

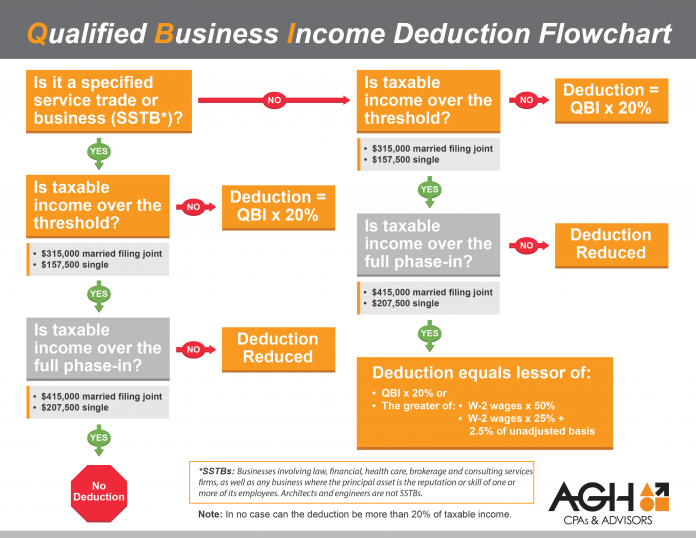

The measure of your available pay (before the certified business pay allowance is calculating). For the year, decides if you can guarantee the full QBI derivation or whether certain impediments become possibly the most important factor. In decreasing or forestalling the allowance. If available pay surpasses the cutoff for your documenting status. At that point, a unique recipe is utilizing to calculate the allowance. The QBI allowance is the lesser of 1 or 2, underneath:

20% of QBI – Qualified Business Income Deduction

(a) half of the W-2 wages (clarified underneath), or (b) 25% of W-2 wages in addition to 2.5% of the unadjusted premise of all certified property (likewise clarified beneath). You can utilize either (a) or (b), whichever is greater.

There’s one more restriction you can’t disregard. Whatever your QBI derivation ends up being, it can’t be over 20% of your available pay without the QBI allowance. You simply need to run the numbers to decide the certified business pay allowance. An extra restriction for a predetermined assistance exchange or business is clarified later.

What does “W-2 wages” mean for the certified business pay allowance?

These are complete wages that your business paid to representatives, including workers’ elective deferrals for commitments to 401(k) plans. It incorporates sensible remuneration paid to an S partnership proprietor representative (even though such payment isn’t important for QBI).

On the off chance that you are an accomplice, a part in a multi-member LLC, or an S company investor, a lot of W-2 wages is an accounting for to you on the Schedule K-1 gives to you by your business.

What does “unadjusted premise of qualified property” meanwhile ascertaining the QBI derivation?

The unadjusted premise of qualified property (UBIA) is the premise of substantial property, for example, gear and apparatus, regardless of devaluation or other discounts. In any case, just consider such property that has not arrived at the finish of the depreciable period or ten years after it’s been put in administration, whichever is later. What Are The Best Meal Replacement Shakes

For instance, you purchase office furniture, which has a 7-year recuperation period for devaluation. You possibly consider this property for a very long time while ascertaining your QBI allowance.

Would I be able to even now guarantee the QBI derivation if I have numerous organizations?

If you own more than one business, figure the QBI derivation for each, and afterward, total up the outcomes. As a reference before, any certain and negative QBI is obtaining.

You might have the option to “total” organizations with the goal that things — QBI, W-2 wages, and UBIA — are adding together in calculating the derivation. Doing so may bring about a bigger allowance than if you’d calculated the derivation independently for every business and afterward added them together.

Convoluted standards oversee the capacity of total organizations, considering proprietorship interests and different elements. Yet, one principle is clear: You can’t total indicated administration exchanges or organizations (I’ll clarify later).

How does the certified business pay derivation influence an independent work charge?

Since the QBI derivation is an individual allowance and not a business allowance, it has no impact on independent work charges. This assessment is figuring whether any QBI allowance can be guarantee.

What is the view as determining assistance exchange or business for the certifying business pay derivation?

A predefined administration exchange or business (SSTB) is an exchange or business including the exhibition of administrations in the fields of wellbeing, law, bookkeeping, actuarial science, performing expressions, counseling, sports, monetary administrations, contributing and speculation the board, exchanging, managing in specific resources or any exchange or business where the key resource is the standing or ability of at least one of its representatives or proprietors.

Obviously, most organizations rely upon the standing or ability of workers and proprietors. Best Qualified Business Income Deduction tips Along these lines, choose whether this adds up to an SSTB for the QBI allowance. An exchange or business’s essential resource is the viewing as the standing or ability of its workers or proprietors. Just if the exchange or business comprises one of the accompanyings:

- The receipt of payment from underwriting items or administrations.

- The utilization of a person’s picture, resemblance, voice, or different images related to a person’s personality.

- Appearance at functions or on radio, TV, and other news sources.

If you are in an SSTB, however. Your available pay is underneath the cutoff examining before; you get the full QBI derivation like some other entrepreneur. Essentially, it doesn’t make a difference that you’re in an SSTB.

What is my QBI if my business isn’t productive?

On the off chance that you have more than one business, you net the pay and misfortunes if the absolute QBI from the entirety of your organization is under zero at that point. You have a negative sum that must be conveying forward to the following year, as clarifying previously.

How might I study the QBI derivation?

The insights regarding applying the QBI derivation to your circumstance aren’t anything but difficult to get a handle on. Luckily, the derivation is figuring for you if you utilize a paid assessment form, on the off chance that you need to improve comprehension of this significant derivation. You can survey IRS FAQs just as directions to the tax documents. Form 8995 and Form 8995-A — used to guarantee the allowance.

Last Words About Qualified Business Income Deduction

About Qualified Business Income Deduction, The Tax Administration distinguished almost 900,000 returns petitioned for 2018. That didn’t take the certified business pay derivation despite the fact that it showed up. Be certain you investigate this significant discount. In the event that you have any inquiries, talk with a CPA or other assessment counsel.