How to write a cheque?

How to write a cheque is not a difficult topic to understand, therefore, we will look at what are the main elements of a cheque to fill in, that without these elements, your cheque may not be entertained or considered.

What are the main elements of a cheque?

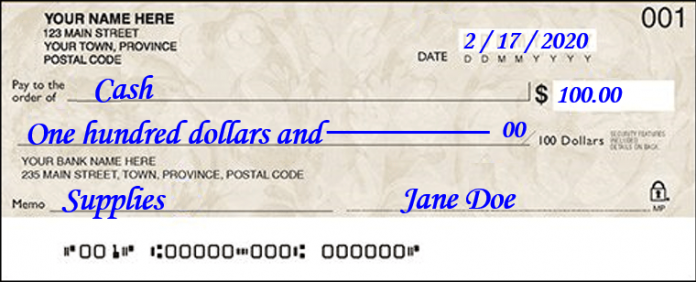

In this article we will look at how to write a cheque correctly and safely. To help us we will consider a cheque, and I recommend you to have your cheque in your hand so you can easily understand what the article says. The main thing to remember is that there are about six elements to remember, that you need to fill in when you are filling a cheque, and we will discuss them in detail one by one in this article.

The main elements we are going to discuss in this article are almost, more or less, the same in most of the countries. So even if your cheque in your country looks a little bit different from this, then do not worry, it is okay as you will almost have to fill the same information, so let us look at these parts. The six pieces of information you need to fill in on a cheque are how to take screenshot on mac?

- The first one is the date, this is almost the same and common element all around the world. Now the date can be written in different ways in different parts of the world. Sometimes in some parts of the world, an international standard has been established, where you have to write the year first then the month and then the day. According to that format, the year would be 2020, and the month would be seventh and the day will be 7 as per this article writing date. However, sometimes in order to let you know that that’s how they want you to mention date in the date section, you might see lightly written over there some of the following sequences.

YYYY/MM/DD, DD/MM/YYYY, and MM/DD/YYYY

Whenever you see something like the above-mentioned formats on a cheque or on any other form, just remember what each of letter represents here. Y stands for year, and YYYY means that they want you to write full form of year there, like 2020, and M stands for month, and MM means complete digit of month, like 07, and DD represent day of the day like 07. You can also write date as July 7, 2020. When you write date in this format, do not forget to put a comma in between day and year.

- Next thing is who we are going to write this cheque to. We write the name of a person or name of a business. The owner of the cheque is mentioned by default on the top of the cheque. However, to whom a cheque is written for is always mentioned in the space given. This is a one to multi relationship in database, if someone understand data base. Write the name of the payee with correct spelling.

- Now comes the important part of any cheque, which is common in every cheque, that is the amount section. In this part of the cheque the amount of a cheque comes in numbers. The most important thing to remember while going for this part is, when you write amount in this section, make sure you write the first number right against the size of the box. If you leave space in the left, you allow somebody to add a number before the number you entered. In this way you can be cheated easily and that would all be your own fault, not theirs. So make sure that you do not allow this to happen. On the right side of the number, someone might cheat you on that side of the number. Do not worry, as we can stop this also from happening by drawing a slash and dash, that represents only. These are the precautions, and you might have some specific style in your country.

- Next part is, amount in words. This part is to confirm because sometimes people do not write their numbers clearly, and cashier gets confused. It is like you are asked by any software to confirm your password, before moving further. This part gives clear idea to the bank that the amount you have written in numbers is the required amount. Start from the very right side leaving no space for someone to put a word or there. Similarly, put a line at the end of cheque words or you can write “only”, so no one can put its words there.

- Now we come to the next crucial part of a cheque, that is almost same in every country, that is the section of signature. Your bank has your signatures at the time of opening account, so this is the way that your bank knows that this cheque is issued by you and see your signatures at the end of cheque mostly. If you want to face no problems in this section, you should have constant signature so bank does not bother you when they match your signature. It is not necessary that you should sign your cheque in English, you can go any way you want. You can sign your cheque in any language, because sometimes people have their own signatures in their own languages. This is perfectly fine and you do not have to sign in English. You do not face any problem as long as you put the same signature that you have recorded in the bank. To sum up, English version of your signature is not important to be produced. There are some other things on your cheque as well, that are the name of your bank, some coding numbers, some routing numbers or your account number and so on. These things can be anywhere on the cheque, different from bank to bank. You do not mess with these thing as these are printed on your cheque already, and you are not required to do anything to them.

- Sometimes there is a little space on cheque under the heading “memo”. You might want to fill out this memo section just to remember that what purpose was that cheque for. It is like a little note to yourself. This section reminds you what that cheque was aimed for, like it could be “for car repair” or anything else.

Above six are the basic and most important elements that are almost same all around the world, and in somehow different sequence, every cheque needs these elements to be filled in.

Some safety precautions, so that you do not make mistakes and blunders

Let me now give you a few other safety precautions so that nobody else can do something illegal to your cheque. So one way to avoid mistakes, or to avoid anybody doing something fraudulent with your cheque is to use CAPITAL letters, because it is harder to change capital letters, so that often advised by the bank to fill in the information in capital letters.

Start writing your numbers at the far left as explained above with the reason and risks involved in leaving space left or right to your numbers or to your words. Leaving no space at the left and right side of the digits makes your cheque safe and nobody can alter the existing information or add something extra to your cheque.

Also make sure to sign consistently and always use the same signature, whatever that signature is, it does not matter, it only needs to be in matching with the registered signature of yours. Effects of Globalization on Developed Countries

Okay, this might be seen obvious that do not ever sign a blank cheque. What do I mean by that is sometimes you might not know the name of the business or the person you are going to give cheque to. You sign a cheque and put it in your pocket and decide to fill it when you get there. This is a very dangerous way as you know that you can lose you blank signed cheque and anyone can fill it and cash it as much amount as he wants. To avoid this, only sign a cheque after you fill it completely with the payee name on it and amount specified on it with the above mentioned precautions.

Do not ever write to cash while withdrawing money, instead write your name, because if you lose the cheque anyone can cash it and get your money out of your account.

Two small points before we end, always write 40 in words as forty not fourty, as many people do make this mistake, therefore I thought I should clear this too for your benefit and ease. Stress Symptoms, it’s Causes and Precautions? Make sure you have written the words against your numbers in a correct manner as people mostly make mistakes here too. This is all about writing a cheque and some safety measure to be taken while filling a cheque.

gu4wxu

iczjoh

lxwcj6

Wow, fantastic weblog layout! How lengthy have you ever been running a

blog for? you made blogging look easy. The full look of your

site is magnificent, let alone the content! You can see similar here najlepszy sklep

6y19dm

uj2z33

Hey there! Do you know if they make any plugins to assist with SEO?

I’m trying to get my blog to rank for some targeted keywords but I’m not seeing very good results.

If you know of any please share. Many thanks! I saw similar blog here:

Scrapebox List

xtxpih